GST increase Singapore 2022

This application is a service of the Singapore Government. 4225 What will 2022 be like for you.

Retail 16000 Fire Sale 10000 Wire New Rolex Black Dial 31mm Oyster Perpetual Date Just With Yellow Gold And Diamonds Come Rolex New Rolex Oyster Perpetual

The Inland Revenue Authority of Singapore IRAS will be revising the Annual Values AVs of HDB flats upwards by 4 to 6 with effect from 1 January 2022 in line with the increase in market rentals.

. Rate of taxation When it comes to GST vs VAT tax VAT is typically higher than GST. One of the benefits of registering for GST is that you can claim the GST incurred on your purchases subject to the conditions for claiming input taxHowever if you are a partially exempt business PDF459KB or an organisation with business and non-business activities PDF 696KB you will not be able to claim your input tax in full as the input tax attributable to the making of. 2100 Helping your fellow Singaporean.

Singapores economy is. Japan 1989 Malaysia 2015 Australia 2000 Singapore 1994 and Canada 1991 already have the GST in place. GST increase to 7 On 15.

GST collections record the second highest monthly mop up in. Finance minister to deliver Singapores Budget 2022 on Feb 18. GST is charged at 7 on the supply of goods and services made in Singapore by a taxable person in the course or furtherance of ones business and the importation of goods into Singapore.

Govt has to start moving on GST increase in Budget 2022 as economy emerges from Covid-19 says Singapore PM Lee. Over 7000 diners advised to return dirty dishes at coffee shops food courts during 2-month advisory period. The AV revision is part of IRAS annual review of properties to compute the property tax payable.

Join the Online GST Certification Course at IIM SKILLS today for a lucrative career. 3929 The future of employment and the Singapore job market. Changed tax rates will come into effect from January 1 2022.

Exporters who have received capital goods under the EPCG scheme are allowed to claim the refund of the IGST paid on exports. Another motivating factor for the government would be the fact that delaying this unpopular legislation much longer would bring it dangerously close to the impending Presidential. SOIL Gurgaon PGPM PGDM Admission 2022.

On 16 February 2021 Budget Day Finance Minister Heng Swee Keat announced that GST will be. What trends will persist in 2022. In November 2021 the GST had increased to Rs152 crore.

2500 Elderly who cant afford to retire. SDMIMD Mysore PGDM Admission 2022. Thereafter many European countries introduced it in 1970-80s.

3 Dec 2021. The government had previously said that the GST increase - by 2 percentage points to 9 per cent - would take place at some point between 2022 and 2025 with the expectation to implement it sooner. 3130 The new norm.

MyTax Portal is a secured personalised portal for you to view and manage your tax. IMT Common Admissions 2022 Know More. On top of these abovementioned areas we should expect to incur higher expenses not only due to inflation but also because of the planned increase in Goods and Services Tax GST.

Exempttax-free items Its also worth noting that some goods which are exempt from VAT may not be exempt from GST and vice. The Government will have to start moving on the planned hike in Goods and Services Tax GST in Budget 2022 given that the economy is. Singapore GDP growth to slow to 3-5 in 2022 after 7 gain this year Related Story Singapore raises 2021 trade forecasts but sees growth easing next year from high base.

In view of uncertainty due to the COVID-19 pandemic the GST increase will be deferred to after year 2022 with a S6 billion Assurance Package proposed in 2020 to cushion the impact when the hike kicks in. Canada has a dual model like in India the State GST and Central GST. From the US to India -- collectively committed this year.

Prior to the change in tax structure the GST on MMF MMF yarn and MMF fabrics were 18 12 and 5 respectively. Getting the details right in 2022 will be no easier. Follow us on Facebook and join our Telegram channel for the latest updates.

Excluding Goods and Services Tax GST the tariff for households will go up from 2411 cents to 2544 cents per kWh for the quarter ending Mar. Government Social Safety Net. TCS to be collected at the rate of o5 under CGST Act on the value of net taxable.

SINGAPORE - The plan to raise the goods and services tax GST between next year and 2025 remains unchanged Finance Minister Lawrence Wong. The Ministry of Finance had released a statement saying that the GST revenue for Meghalaya in November last year was Rs120 crore. While Singaporeans were assured in Budget 2021.

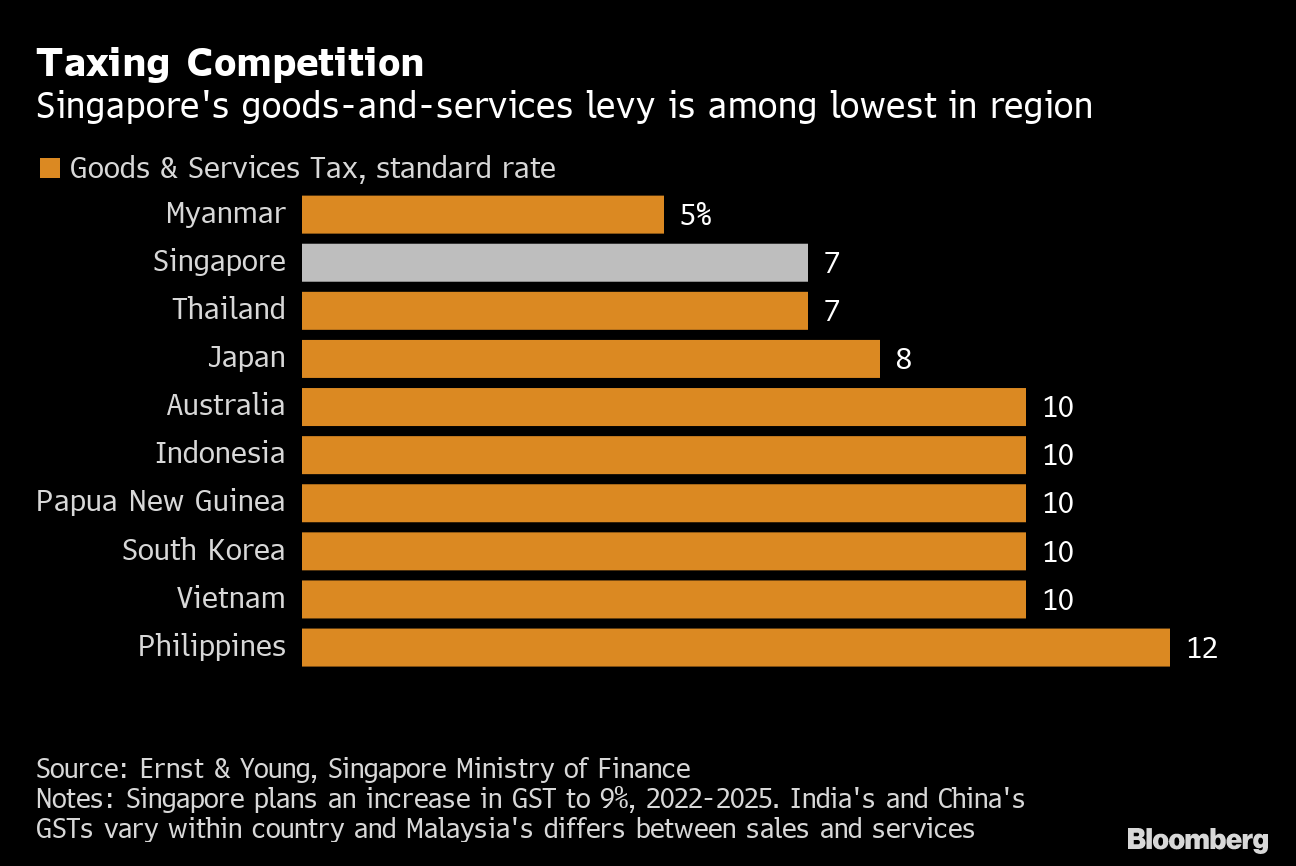

SINGAPORE As Singapores economy emerges from Covid-19 the Government has to start moving on the planned increase in the Goods and Services Tax GST from 7 per cent to 9 per cent said. Whereas the rate of VAT in the UK is 20 the rate of GST in Australia Singapore and Canada is 10 7 and 5 respectively. DBS analysts positive on Singapore outlook in 2022 although market swings expected Singapore economy DBS analysts positive on Singapore outlook in 2022 although market swings expected.

To stay ahead of. Higher carbon prices and environmental taxes increase production costs for industrials while under-investment in fossil fuels has contributed to a spike in energy costs that threatens to dampen growth and disrupt output. The decision is.

Felicia Tan Published on Wed Dec 01 2021 1146 PM GMT8. It was announced in the 2018 Budget that this rate would be increased to 9 sometime between 2021 and 2025. It is a comprehensive tax subsuming.

GST on imported low-value goods. First announced in the Budget 2018 GST is expected to increase from 7 to 9 from 2022 to 2025. Plans to raise the GST from 7 to 9 per cent between 2021 and 2025 were first announced in 2018 but was later pushed back to between 2022 and 2025 because of the pandemic.

Govt has to start moving on GST increase in Budget 2022 as economy emerges from Covid-19 says Singapore PM Lee Saturday 01 Jan 2022 0808 AM MYT Prime Minister Lee Hsien Loong says the government has to start moving on the planned increase in the Goods and Services Tax GST from 7 per cent to 9 per cent. Meghalaya had seen an increase in its Goods and Services Tax GST revenue by 27 in November 2021. Key Updates on GST.

SINGAPORE The electricity tariff for the first quarter of 2022 will increase by an average of 56 per cent for households in Singapore compared with the previous quarter due to higher fuel costs SP Group said on Thursday 30 December. GST To Increase After 2022. While the exact time of the hike is uncertain the economic recovery and falling unemployment rate present a great opportunity for a GST hike to be introduced in the Budget 2022.

In the 2021 Budget the specific date for the GST rate. The revision by 133 cents per kWh on average for 1 January.

Consumers To Pay Rs 21 344 In Taxes For Iphone 13 Mini Up To Rs 40 034 90 For Iphone 13 Pro Max Businesstoday

Gst Singapore A Complete Guide For Business Owners

Gst Singapore A Complete Guide For Business Owners

Gst Singapore A Complete Guide For Business Owners

What India Can Learn From Failure Of Malaysia S Gst

India Public Opinion On Gst 2019 Statista

Gst Singapore A Complete Guide For Business Owners

India Monthly Gst Collections 2020 Statista

20 Summer Offer For Retail Pos Software Billing Software Management Information Systems Inventory Management Software

India Number Of Gst Taxpayers In India 2020 By State Statista

Corporate Travel Corporate Travel Booking Hotel Vacation Packages

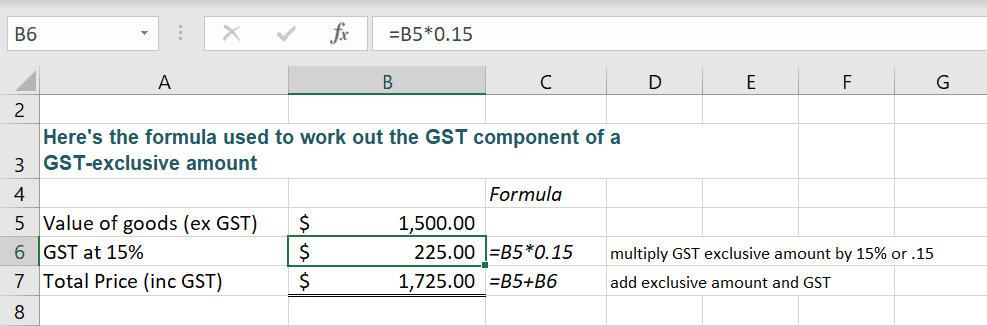

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

Gst Singapore A Complete Guide For Business Owners

Gst Singapore A Complete Guide For Business Owners

The Gst Tax Rate Structure In India Download Table